Bad debt expenses are the losses you incur when you can’t collect the debt someone owes you. In these situations, the company or individual owing the money can’t pay the agreed amount, whether that’s due to slow-moving funds or bankruptcy. You then have to calculate and acknowledge the debt as an expense in your ledger. Learn how to calculate your bad debt expenses with this comprehensive guide. But when you offer goods or services to a client, you expect to get paid on time. Unforeseen circumstances can lead to delays in receiving payments, and sometimes, you can’t recover a debt at all.

Ageing of accounts receivable formula

The term bad debt refers to outstanding debt that a company considers to be non-collectible after making a reasonable amount of attempts to collect. These debts are worthless to the company and are written off as an expense. Utilize advanced accounting software for streamlined invoicing, automatic reminders, and real-time accounts receivable insights. Switching to automated systems can be a game-changer, saving you time, eliminating mistakes, and offering up data that’s gold for making smart choices. Communicate payment terms upfront, including specific due dates and the consequences of late payments. Bad debt expenses represent the money a business doesn’t expect to collect from customers who bought products or services on credit.

Bad debt expense formula Definition & Calculation

Basically, this method anticipates that some of the debt will be uncollectable and attempts to account for this right away. Invoice immediately after a sale and diligently follow up on overdue payments. Early reminders and consistent communication can significantly increase your chances of collecting owed money. However, as most small business owners know, that’s a far cry from reality. Customers will often delay their payments or avoid paying altogether for goods or services they purchased from you.

- Though part of an entry for bad debt expense resides on the balance sheet, bad debt expense is posted to the income statement.

- Ramp is an excellent choice for startups that are aiming to earn rewards on business purchases while managing expenses.

- Recognizing these expenses can help businesses create bad debt write-offs.

- Generally, the longer an invoice remains unpaid, the lower the likelihood of it being settled.

- The major problem with the direct write-off is the unpredictability of when the expense may occur.

- Discover smart advice from one of our clients, Yaskawa America, who achieved zero bad debt by leveraging automation.

- Bad debt expense is reported within the selling, general, and administrative expense section of the income statement.

Establish Transparent Credit Guidelines

This is the ultimate guide to construction payment for general contractors, subcontractors, and suppliers. The true loss of bad debt to a company is more than just the amount of the debt itself. Some of its features include receipt matching, subscription management, and AI-powered spending insights. Ramp is an excellent choice for startups that are aiming to earn rewards on business purchases while managing expenses. When it comes to business longevity, consistent cash flow, effective inventory management, and proper…

Percentage Of Sales Method

The major problem with the direct write-off is the unpredictability of when the expense may occur. Consider a company that has a single customer that has a material amount of pending accounts receivable. Under the direct write-off method, 100% of the expense would be recognized not only during a period that can’t be predicted but also not during the period of the sale. The company had the existing credit balance of $6,300 as the previous allowance for doubtful accounts.

- There are two ways to estimate bad debt – the percentage of accounts receivable method and the percentage of sales method.

- Also called doubtful debts, bad debt expenses are recorded as a negative transaction on your business’s financial statements.

- Understanding how to calculate bad debt expense is crucial for financial health and accurate reporting.

- With the write-off method, there is no contra asset account to record bad debt expenses.

- When you finally give up on collecting a debt (usually it’ll be in the form of a receivable account) and decide to remove it from your company’s accounts, you need to do so by recording an expense.

- Bad debt is all debt or outstanding credit sales that cannot be collected on during a given period.

- Here’s why this measurement of the profitability of your operations is important.

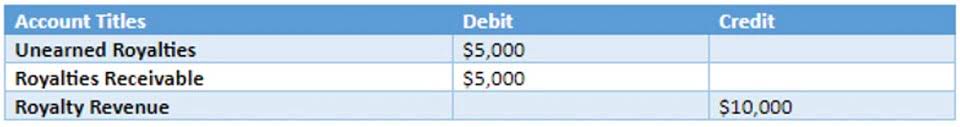

There are two distinct ways of calculating bad debt expenses – tBad debt expense is account receivables that are no longer collectible due to customers’ inability to fulfill financial obligations. There are two distinct ways of bad debt expense calculator calculating bad debt expenses – the direct write-off method and the allowance method.he direct write-off method and the allowance method. Bad debt expense is a natural part of any business that extends credit to its customers.

Method 1: The Direct Write-Off Method

You can buy index mutual funds and ETFs designed to track the Nasdaq composite. Once listed, companies must continue to meet Nasdaq’s continued listing standards, which include at least 400 total shareholders. However, the Nasdaq Stock Market has eligibility requirements for listing on the exchange. The top 10 companies represent https://www.bookstime.com/ a total combined index weighting of more than 50%. The Nasdaq composite is market capitalization weighted, meaning larger, more valuable companies have a greater impact than smaller, less valuable companies. The Nasdaq composite and Dow Jones Industrial Average are the most popular U.S. stock market benchmarks.

What Are Bad Debt Expenses?